Securing a Tanzanian tax ID may seem like an intriguing pursuit, especially when you realize that Tanzania is emerging as a significant economic hub in East Africa. Navigating the Tanzanian Revenue Authority’s (TRA) system can be both a breeze and a challenge. Whether you’re a local entrepreneur aiming to stay compliant or an international investor keen on understanding the local tax obligations, the process remains a crucial step.

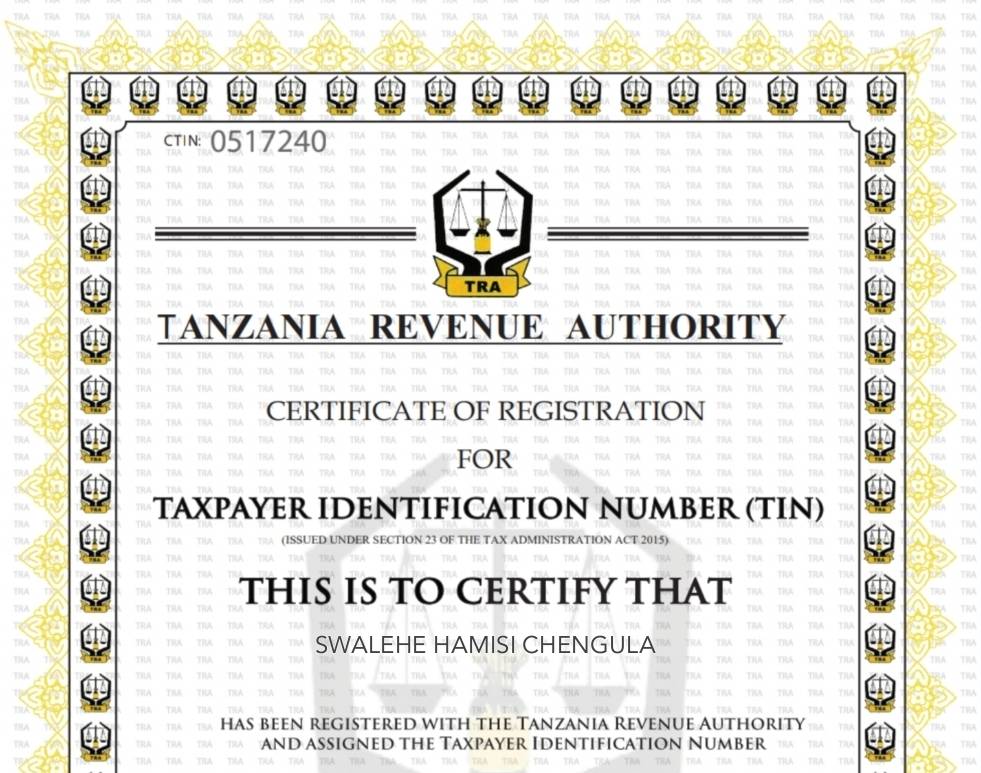

To obtain a Tanzanian tax ID, you need to visit a TRA office with the necessary documents, including your national ID or passport and proof of your business registration. The Tanzanian tax system, formalized in the 1990s, has made strides in becoming more accessible and efficient. Did you know that in recent years, the TRA has significantly reduced the time required to process a tax ID due to digitalization efforts?

- Gather required documents such as national ID or passport and business registration certificate.

- Visit the nearest Tanzania Revenue Authority (TRA) office.

- Complete the tax registration form with accurate details.

- Submit your application and all documents to the TRA officer for verification.

- Wait for notification from TRA to collect your tax ID once processed.

How do I get a Tanzanian tax ID?

Securing a Tanzanian tax ID begins with gathering the necessary documents. You’ll need your national ID card if you’re a citizen, or a valid passport if you’re a foreigner. Business owners must also present their business registration certificate. For a smoother process, make sure all your documents are up-to-date. Being prepared can save you a lot of time at the Tanzania Revenue Authority (TRA) office.

Once you’ve gathered your documents, visit the nearest TRA office. You might want to arrive early because it can get busy. At the TRA office, you’ll fill out the required tax registration forms. The staff there can assist you if you have any questions. They will then process your application.

After submitting your application, the processing time can vary. Typically, it takes a few days to a week to get your tax ID. The TRA will notify you once your tax ID is ready. You can then collect it from the TRA office where you submitted your application. Make sure to double-check all the information on your tax ID for any errors.

Having a Tanzanian tax ID is crucial for legal and financial activities in the country. It’s needed for business transactions, tax returns, and other formal processes. According to the article, having a tax ID also helps in building trust with clients and suppliers. If you plan to climb Kilimanjaro, it’s essential to understand the local tax laws. Staying compliant with tax regulations can help you avoid legal troubles and fines.

Step 1: Gather Required Documentation

Before you can apply for a Tanzanian tax ID, you need to collect all necessary paperwork. Citizens of Tanzania will need their national ID card. Foreigners should have a valid passport. Additionally, those starting a business will require a business registration certificate. Ensuring these documents are in order is the first crucial step.

It’s essential to check that all documents are current and accurate. Any expired IDs or incorrect information can delay the application process. For those who don’t have a national ID or passport, you can apply for one at the relevant local office. Make sure to keep copies of these documents for your records. This will help in case anything gets lost.

If you are unsure about what exactly you need, the TRA website has detailed information. They also provide contact details if you have specific questions. Organizing your paperwork in advance can save a lot of headaches. According to the article, many applicants face delays due to missing or incorrect documents. However, you can avoid these common pitfalls with a bit of preparation.

It’s beneficial to have a checklist for all required documentation. This checklist can include items like:

- National ID Card or Passport

- Business Registration Certificate

- Proof of Address

- Tax Registration Form

Following these steps and having all the required documents in place will help make the process smooth and efficient.

Step 2: Visit the Tanzania Revenue Authority Office

After gathering all necessary documents, the next step is to visit the Tanzania Revenue Authority (TRA) office. It’s a good idea to arrive early to avoid long queues. Make sure you bring all your documents in an organized folder. This will make it easier for the TRA officers to assist you. Keeping everything in order will also speed up the process.

When you arrive at the TRA office, you’ll likely need to fill out a tax registration form. The form asks for personal details such as your name, address, and type of business if applicable. If you have any questions or uncertainties while filling out the form, the TRA staff are there to help. They can guide you through the process and explain any required sections. Accurate and complete information is crucial for a smooth application.

After completing the form, you will submit it along with your gathered documents. The TRA staff will review your application to ensure everything is in order. If there are any issues, they will inform you and provide instructions on how to correct them. According to the article, having all documents ready greatly reduces the risk of delays. Being prepared makes the visit straightforward and efficient.

While at the TRA office, you may also have the opportunity to ask questions related to other tax obligations. This can be an excellent time to clear up any confusion regarding annual filings or specific tax policies. Don’t hesitate to use the resources available. Taking this step seriously will ensure you are on the right track with your tax obligations. Following proper procedures at the TRA can pave the way for a successful business journey in Tanzania.

Step 3: Submit Your Application and Receive Your Tax ID

Once your documents are ready and you’ve filled out the necessary forms, it’s time to submit your application. Hand over all your materials to the TRA officer. They will review and verify everything before proceeding. If everything is in order, they’ll get started on processing your tax ID. Ensure you have copies of all your documents for your records.

During the verification process, the officer may ask some questions or request additional information. This is usually to clarify any details or to ensure the accuracy of your application. Don’t worry if this happens; it’s a standard procedure. Being cooperative and providing the additional information promptly can expedite the process. Transparency can go a long way.

Once the TRA staff have confirmed that your application is complete, they will begin the formal process of issuing your tax ID. This can take a few days to a week, depending on the workload at the TRA office. You will be informed when the processing is completed. To avoid unnecessary delays, follow up if you don’t hear back within the expected time frame.

The TRA will notify you when your tax ID is ready for collection. You can pick it up from the same office where you submitted your application. Ensure you bring a form of identification when collecting your tax ID. This is important as the officers need to verify that the tax ID is being handed to the correct individual. Accuracy in picking up your tax ID prevents any future complications.

Upon receiving your tax ID, double-check all the information to ensure its correctness. If any errors are found, notify the TRA immediately to rectify the issue. Having the correct details on your tax ID is critical for your business operations. Keeping your tax ID safe is equally important. This unique identifier will be used frequently for various financial and legal transactions.

It’s also a good idea to digitize important documents related to your tax ID. Scanning and storing these documents in a secure digital format can prevent loss and ease future access. Here’s a small checklist to consider:

- Verify all details on the tax ID

- Store the physical copy securely

- Digitize and store copies in a secure location

- Keep a list of all interactions with TRA for future reference

Following these steps will help you manage your Tanzanian tax ID efficiently and securely.

Key Benefits of Having a Tanzanian Tax ID

Having a Tanzanian tax ID offers multiple advantages for individuals and businesses. First and foremost, it ensures compliance with local tax laws, avoiding legal complications. With a tax ID, businesses can operate smoothly without worrying about hefty fines or penalties. It also simplifies the process of filing tax returns. Compliance leads to fewer bureaucratic hurdles.

A Tanzanian tax ID builds credibility and trust with potential clients and partners. When your business exhibits proper registration and legal compliance, customers feel more secure dealing with you. This boosts your reputation in the market. It can also lead to increased business opportunities. Transparency in financial dealings attracts more partnerships.

Financial access is another key benefit. Banks and other financial institutions require a tax ID for opening business accounts. It’s also needed for applying for loans and other financial services. A tax ID can therefore significantly improve your business’s cash flow. The ability to access diverse financial resources can fuel growth and expansion.

Another advantage is eligibility for government contracts and tenders. Government projects often offer lucrative opportunities. However, they require businesses to have an official tax ID. Meeting this requirement can open doors to substantial contracts. These contracts can play a vital role in scaling your business.

Lastly, possessing a tax ID ensures you contribute to the country’s development. Taxes collected are used for national development projects. Roads, schools, and healthcare facilities benefit from these taxes. By paying your share, you play a part in improving public services. This civic responsibility brings a sense of contribution to society.

Common Challenges and Solutions in Obtaining a Tanzanian Tax ID

One common challenge in obtaining a Tanzanian tax ID is the lack of clear information. Many applicants are unsure about the documentation required. This can lead to delays and frustration. To overcome this, it’s important to visit the official TRA website or consult with a TRA officer. Gathering the right documents beforehand can save a lot of time.

Another issue is long wait times at the TRA office. The TRA offices can get very busy, especially on weekdays. This can result in long queues and extended waiting periods. To avoid this, it’s a good idea to visit earlier in the day. Some offices also allow you to book appointments online.

Errors in the application form can cause major setbacks. Simple mistakes like incorrect personal details can lead to rejection. Always double-check your form before submission. If necessary, seek help from TRA officers to ensure accuracy. Ensuring your application is error-free is crucial for quick approval.

Language barriers can also be problematic for non-native speakers. The application forms and instructions are primarily in Swahili. Non-native speakers might find it challenging to understand the nuances. Bringing a translator or a Swahili-speaking friend can help tremendously.

Finally, some applicants might experience technical difficulties when accessing online resources. This is particularly challenging for those not well-versed with computers. Visiting a TRA office for hands-on assistance can be helpful. TRA staff can guide you through any problems you encounter online.

Addressing these challenges proactively can make the process smoother. Here are some quick tips:

- Conduct thorough research on required documents.

- Arrive at the TRA office early to avoid long queues.

- Double-check your application for errors.

- Consider language assistance if needed.

- Seek TRA staff help for technical issues.

Following these strategies can significantly ease the journey to obtaining your tax ID.

Key Takeaways

- Gather necessary documents like ID or passport, and business registration.

- Visit the Tanzania Revenue Authority office early to avoid long waits.

- Fill out the tax registration form accurately and completely.

- Submit your application with all required documents for verification.

- Wait for notification and then collect your processed tax ID.